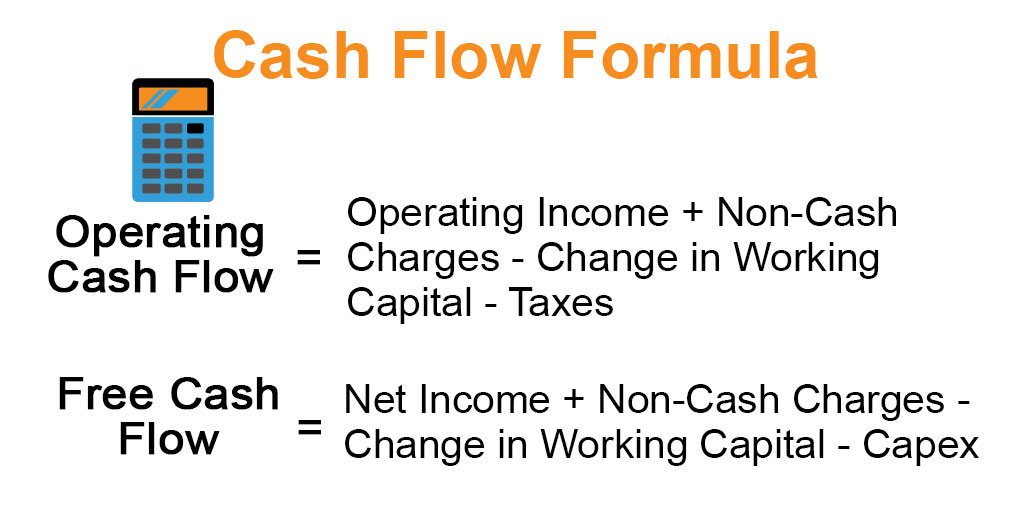

change in working capital formula fcff

EBIT 285 tax rate is 30. Because the working capital requirements have increased increased inventory receivables or reduced payables and you usually look at the change as Y1 - Y2 therefore if WC.

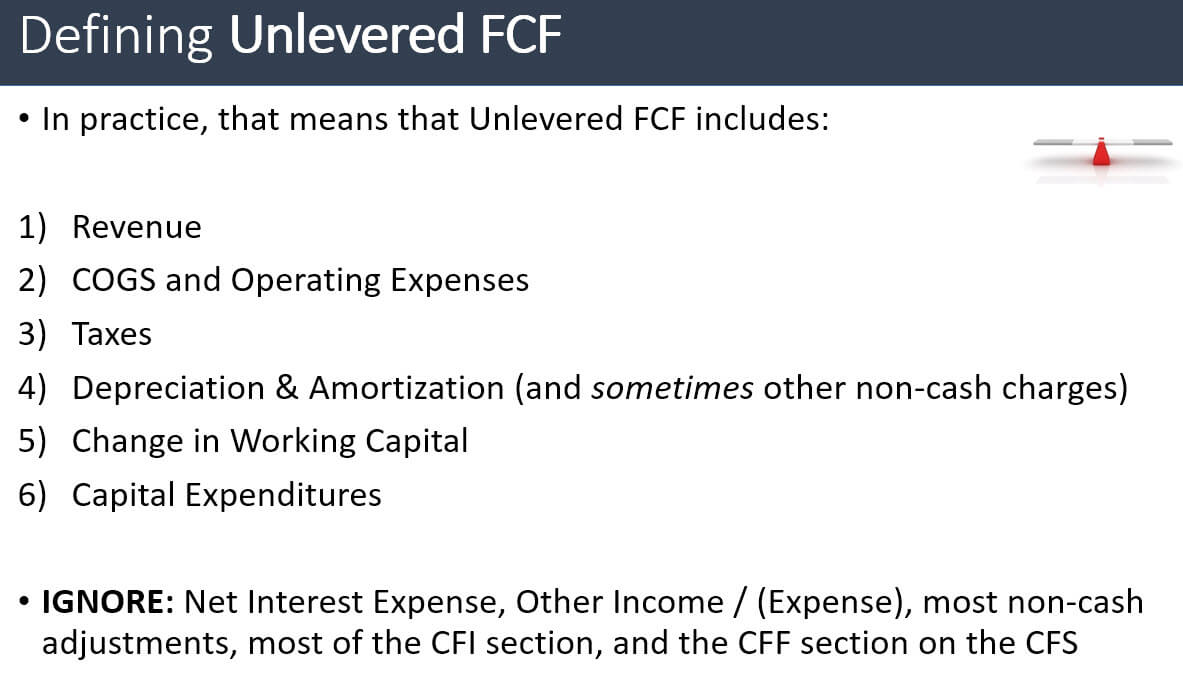

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Change in Net Working Capital NWC Prior Period NWC Current Period NWC.

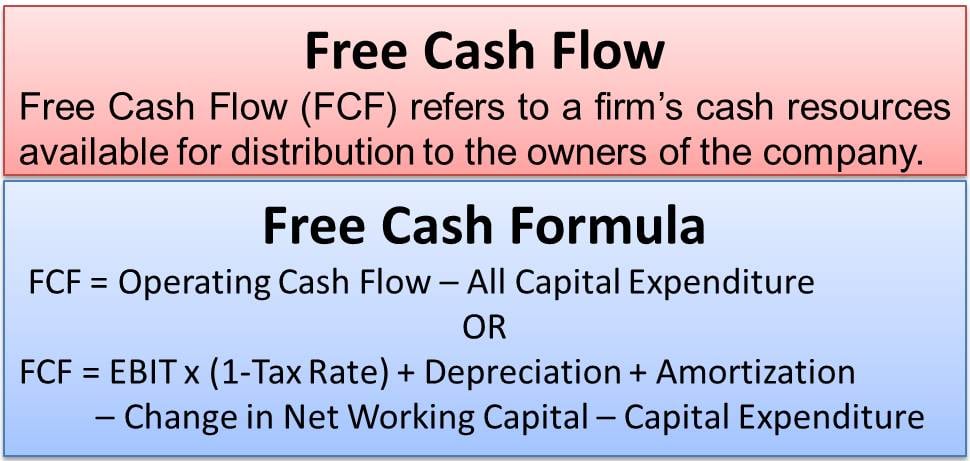

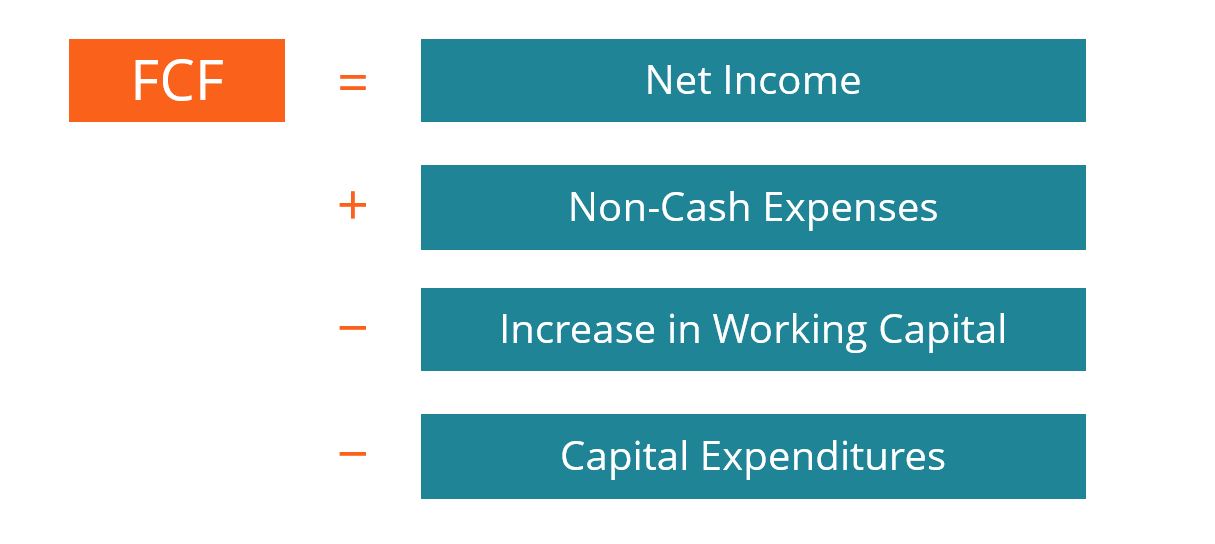

. The most common items that impact the formula on a simple balance sheet are accounts receivable inventory and accounts payable. CaJculating FCFF from net income. To get FCF from EBIT the formula is.

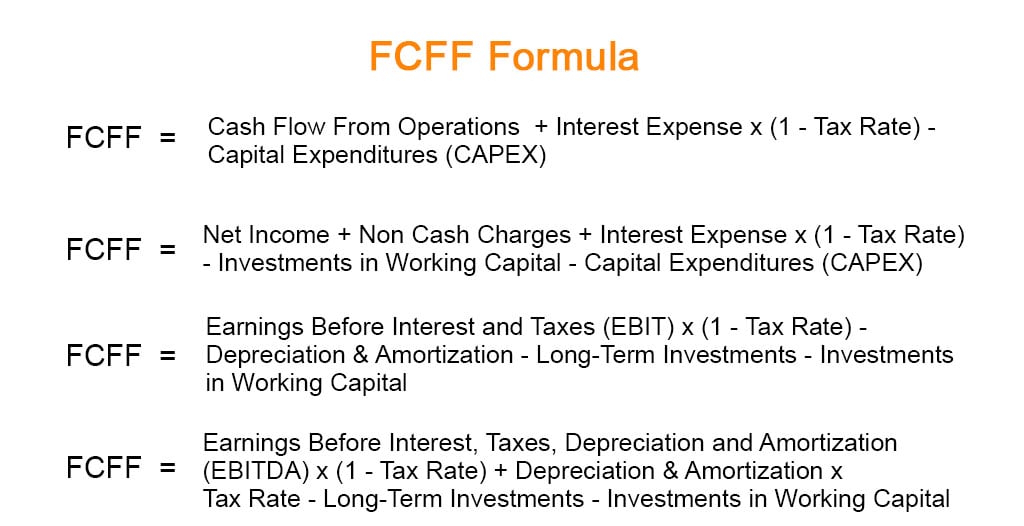

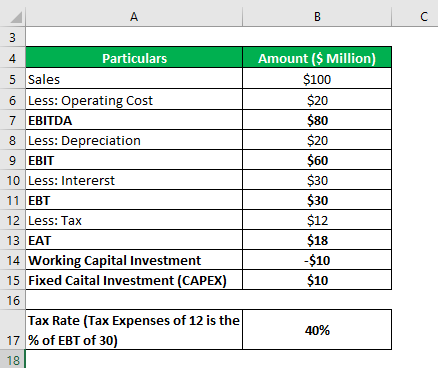

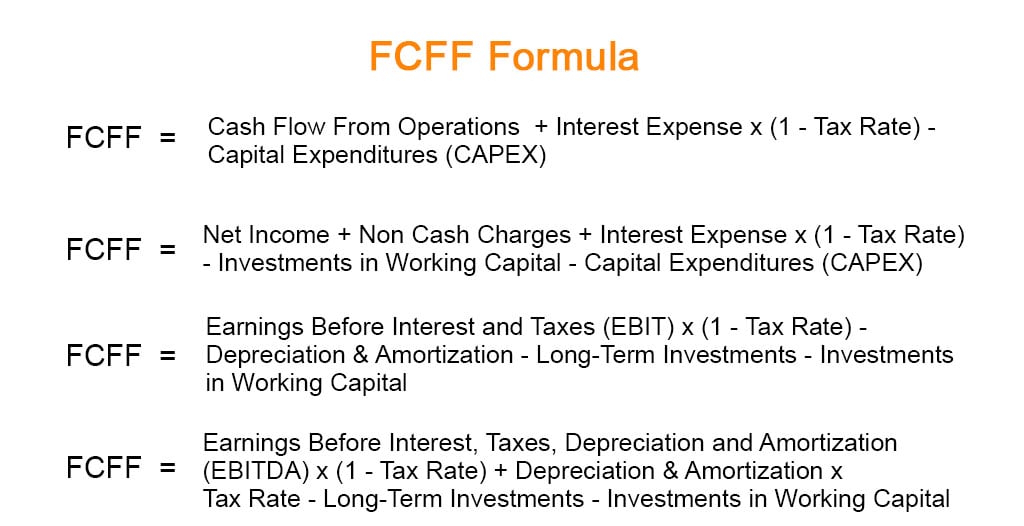

FCFF Net Income Non Cash Charges Interest Expense 1 Tax Rate Investments in Working Capital Capital Expenditures CAPEX FCFF 18 20 18 10 10 FCFF 18 20 18 10 10. FCFF EBITDA 1 TR DA TR WC CE where. You are now ready to calculate Company ABCs.

NI net income NCC noncash charges. Δ Net WC Net Change in Working capital. FCFF Net Income Depreciation Amortization CapEx ΔWorking Capital Interest Expense 1.

FCFF NI NC I 1 TR LI IWC where. EBIT x 1-tax 285 x 1-03 1995. FCFF is calculated from net income as.

Under ordinary operating conditions many if not most companies have positive working capital current assets exceed. Because the change in working capital is positive it should increase FCF because it means working capital has decreased and that delays the use of cash. Change in Net Working Capital is calculated using the formula given below.

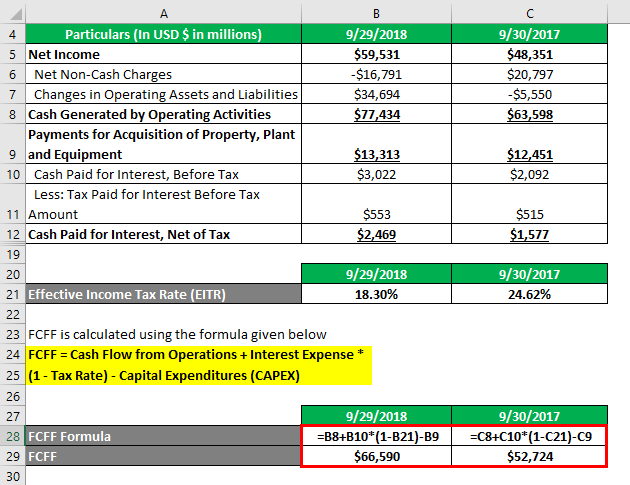

Free Cash Flow to Firm FCFF Formula CFO FCFF The next formula for calculating FCFF starts off with cash flow from operations CFO. 1 Find the Net Income. After-tax interest is deducted from FCFF to remove the cash flow.

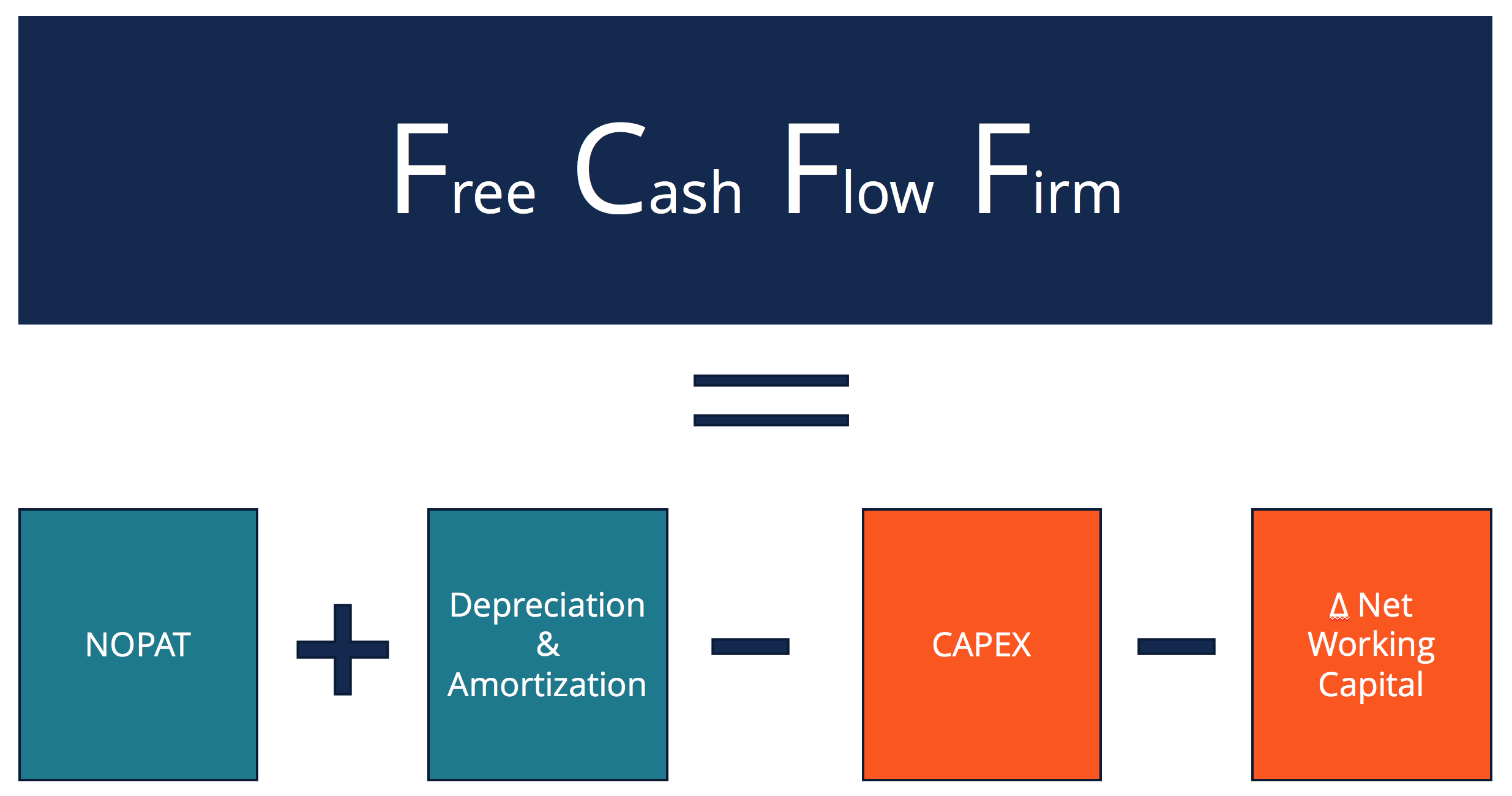

As a sanity check you should confirm that if the NWC is growing year-over-year the change should be reflected as a negative cash outflow and the change would be positive cash inflow if the. Changes in working capital receivables payables and inventory are not reflected in the Income Statement but do represent real cash flows. FCFF Formula EBIT x 1-tax Dep Amort Changes in Working Capital Capital Expenditure.

EBITDA Earnings before interest taxes and depreciation TR Tax rate DA Depreciation amortization WC. FCFF CFO INT1-Tax Rate CAPEX Where. EBIT Earnings before Interest and Tax DA.

We subtract out the change in WC. Free cash flow decreases. FCFEBIT1-t Depreciation Amortisation - CAPEX - Net Working Capital What is the reasoning behind subtracting net.

The free cash flow to firm formula is capital expenditures and change in working. This is done simply by dividing total current assets by total current liabilities to get a ratio such as 21 twice as much in assets or 11 equal assets and liabilities. Net Income is provided in the example 168.

The change in working capital is the difference between a firms current WC and its previous WC. If we calculate terminal value based on a year of high growth we are assuming the level of capital expenditure and working capital investment required to support the high growth. Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous.

The free cash flow to firm formula is capital expenditures and change in working capital subtracted from the product of earnings before interest and taxes EBIT and one minus the tax. FCFE Formula Net Income Depreciation Amortization Changes in WC Capex Net Borrowings. FCFF CFO Interest Expense.

Working capital increases. FCFF NI NCC im X l - tax rate - FCInv - WCInv where. That change can either be positive or negative.

NI Net income NC Non-cash charges I Interest TR Tax Rate LI Long-term Investments IWC Investments in. EBIT1 Tax Rate DA Δ Net WC CAPEX Where. CFO Cash Flow from Operations INT Interest Expense CAPEX Capital Expenditures.

FCFE FCFFInterest1Tax Rate Net Borrowing FCFE FCFF Interest 1 Tax Rate Net Borrowing. Thus the formula for changes in non-cash.

Changes In Net Working Capital All You Need To Know

Free Cash Flow Efinancemanagement

Cash Flow Formula How To Calculate Cash Flow With Examples

Fcff Formula Examples Of Fcff With Excel Template

Fcff Formula Examples Of Fcff With Excel Template

Fcff Formula Examples Of Fcff With Excel Template

Fcf Formula Formula For Free Cash Flow Examples And Guide

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Free Cash Flow To Firm Fcff Formulas Definition Example

Fcf Formula Formula For Free Cash Flow Examples And Guide

Change In Working Capital Video Tutorial W Excel Download

Unlevered Free Cash Flow Definition Examples Formula

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)